Recruiting the right participants is at the heart of successful market research. In the UK, where demographics are diverse and expectations are high, the accuracy and relevance of your insights depend heavily on who takes part in your study. Whether you’re launching a new product, evaluating user experiences, or testing public opinion, the people involved must reflect your target audience as closely as possible.

That’s where participant recruitment agencies come in. These agencies find, screen, and manage respondents, allowing researchers to focus on data collection and analysis. However, not all agencies deliver the same quality. Working with a top UK participant recruitment agency can be the difference between surface-level feedback and real, actionable insights.

This article explains why participant recruitment is important, what sets top agencies apart, how quality insights are delivered, and why partnering with the right agency helps research teams save time, reduce risk, and improve outcomes.

Why Participant Recruitment Matters in the UK

The UK market is dynamic and multicultural. It includes consumers from different age groups, income levels, ethnic backgrounds, regions, and social classes. From tech hubs in London and Cambridge to rural communities in Yorkshire and Wales, preferences and behaviors vary widely. This makes participant selection a critical part of any research process.

Targeted Recruitment Brings Better Results

If your research is directed to young professionals, parents of children under 10, retired homeowners, or any other specific group, a general call-out will not work. Poorly targeted recruitment leads to irrelevant data, unengaged participants, and, in some cases, full project delays. A top-tier market research recruitment agency in the UK understands how to reach niche segments efficiently and respectfully.

For example, random recruitment would waste time and resources if your client is a healthcare brand studying insulin use among adults over 50 in Greater Manchester. A well-structured screening process is needed to ensure every participant meets the exact criteria. Recruiting research participants may seem straightforward, but professionals know it is often one of the most time-consuming and frustrating stages of any research project. Here are some of the common challenges:

1. Low Show-Up Rates

Even with strong recruitment, participants sometimes cancel at the last minute or fail to attend. A top agency has backup systems, like waitlists and reminder workflows, to reduce drop-offs and manage replacements quickly.

2. Poor Fit

Sometimes participants pass the initial screening but do not match the research goal. This may be due to misunderstanding the questions or misrepresenting themselves. Leading agencies use layered screening and follow-up calls to avoid these mismatches.

3. Tight Deadlines

Researchers often work on short timelines. Waiting a week to fill a group can delay entire projects. Top agencies maintain large, pre-vetted participant databases and move fast when needs arise.

4. Sensitive Projects

Certain topics require extra care in recruitment, such as health, finances, or controversial issues. Skilled agencies know how to approach participants respectfully and ensure their consent and comfort.

By anticipating and solving these challenges, strong agencies protect the integrity of your research and reduce your stress as a project lead.

What Makes a Recruitment Agency ‘Top’?

It is not enough to simply find willing participants. A top recruitment agency invests in quality, builds relationships, and continually improves its process. Here are the key traits that define a top agency:

1. Responsiveness and Flexibility

Research timelines change. A reliable recruitment partner adjusts quickly without sacrificing quality. At Peoplesight.co.uk, we offer ongoing updates and adapt to feedback during the recruitment process.

2. Thorough Screening

Top agencies go beyond basic filtering. They craft screening questions that check both demographic fit and behavioral relevance, then follow up to verify consistency.

3. Reliable Communication

A good agency keeps you in the loop. You know how many spots are filled, what profiles are being submitted, and how likely they are to attend. This builds trust and helps your project run smoothly.

4. Access to Diverse Profiles

Access to a wide and diverse participant pool is essential if you need immigrants, muslims, first-time parents, or students in specific cities. Quality recruitment agencies maintain this kind of database through active outreach and long-term relationship building.

5. Ethics and Compliance

A top agency understands GDPR and follows ethical research standards. Participant data is protected, and consent is properly obtained at each stage.

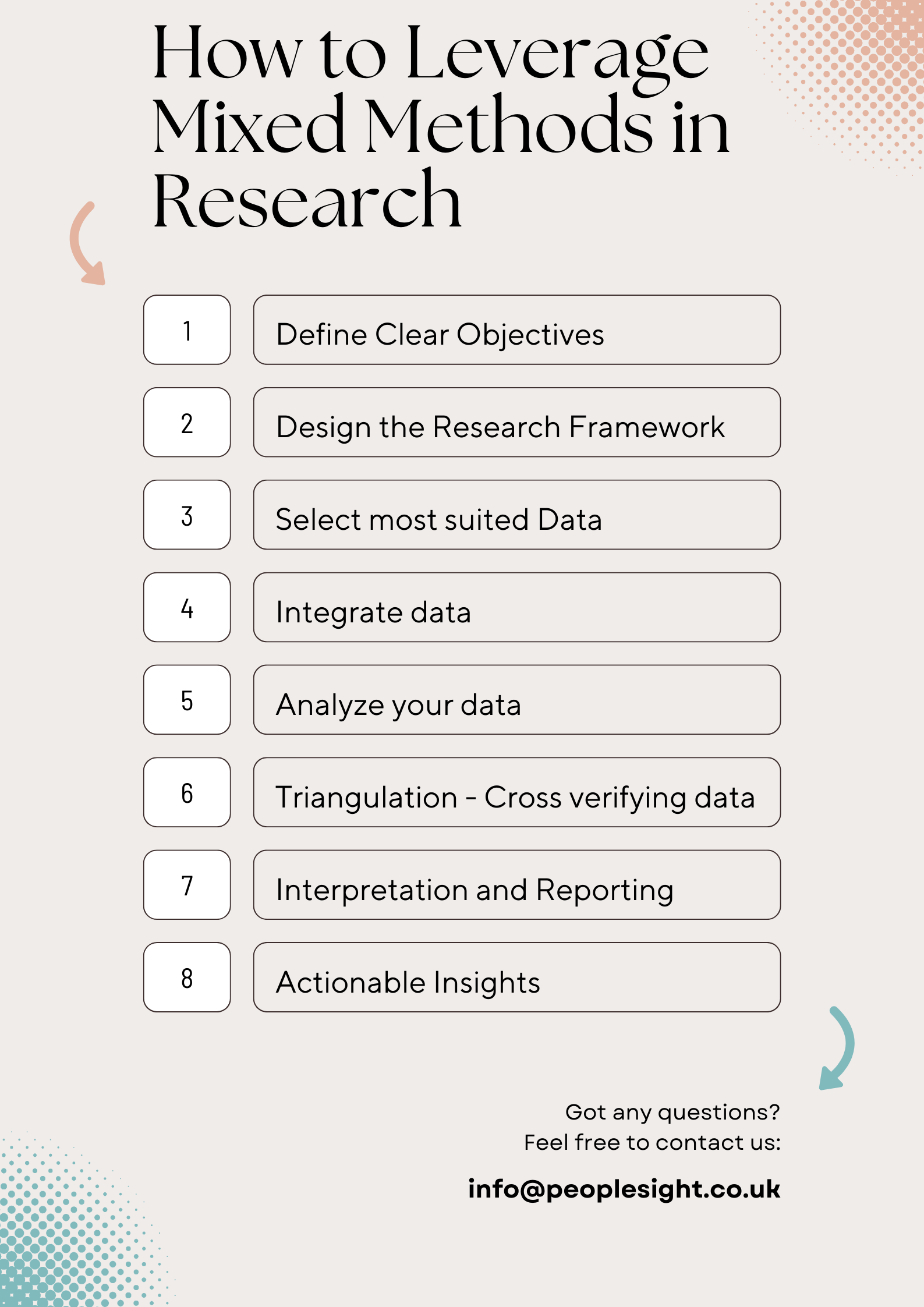

Our Approach at Peoplesight: Delivering Quality Insights

At Peoplesight.co.uk, our recruitment process is structured yet flexible. We begin by understanding the client’s goals. Then we build a sourcing and screening plan that meets those needs with care and precision.

Here’s how we do it:

1. Detailed Briefing

We ask the right questions at the start: Who are you trying to reach? What platform are you using? What formats will you need (in-person, online, diary study, etc.)?

2. Custom Screening

We build custom screeners that go beyond basic demographics. We check behavior, habits, and motivation to ensure relevance.

3. Smart Sourcing

Our network includes consumers, professionals, students, and more. We reach out using email, social media, and referral systems.

4. Confirmation and Engagement

Once selected, we confirm attendance, answer questions, and prepare participants for the session. This ensures they arrive informed and ready to engage.

5. Feedback and Follow-Up

After the study, we collect feedback to help improve future recruitment. We also follow up with clients to measure satisfaction.

Our goal is simple: make research recruitment feel smooth, supportive, and effective from beginning to end.

As noted by the Market Research Society, participant recruitment must be both ethical and accurate to protect data quality and participant safety.

Partner with a Trusted UK Recruitment Agency

When your research relies on real people sharing real opinions, you need participants who are relevant, ready, and reliable. At Peoplesight, we take pride in delivering this standard every time.

Whether you’re launching a new concept, testing a product, or exploring public perception, we help you reach the right audience without delays or complications.

We support independent researchers, brands, startups, agencies, and NGOs across the UK. Our services are flexible, and we tailor every project based on your needs.

Let’s help you run better research.